A few years ago, a new tactic popped up as a way to get unsuspecting sellers to part with their minerals: oil and gas “leases” that were actually royalty deeds.

By way of background, an oil and gas lease is an agreement where the mineral owner leases the rights to produce their minerals to an operator in exchange for some percentage of production, called a lease royalty. So, for instance, an owner might sign a lease with 25% royalty, which means the operator can drill a well and would be entitled to keep 75% of the oil and gas for itself, and the owner would get 25%.

A royalty deed, by contrast, is an agreement that conveys (sells, gives away, or otherwise disposes of) the owner’s royalty interest in the minerals. So if an owner signs a royalty deed with Third Party for 50% of the royalty interest, then if they subsequently sign a lease with a 25% lease royalty, they would keep only half (12.5%), with the other half going to Third Party.

What makes this particular tactic so sketchy is that the royalty deed is made to look like an oil and gas lease. It will by titled “oil and gas lease,” it will call the grantor the “lessor” and the grantee the “lessee,” it will be formatted like a lease, it will have a term of years, and it will be from a company that sounds like an exploration company. In fact, almost everything about these royalty deeds are made to appear as if they are legitimate oil and gas leases. So a casual owner might be easily confused, and accidentally sign away their lease royalty to someone else. It’s only by digging into the granting clause that the owner can know that it’s actually a royalty deed.

So how does an owner spot the difference?

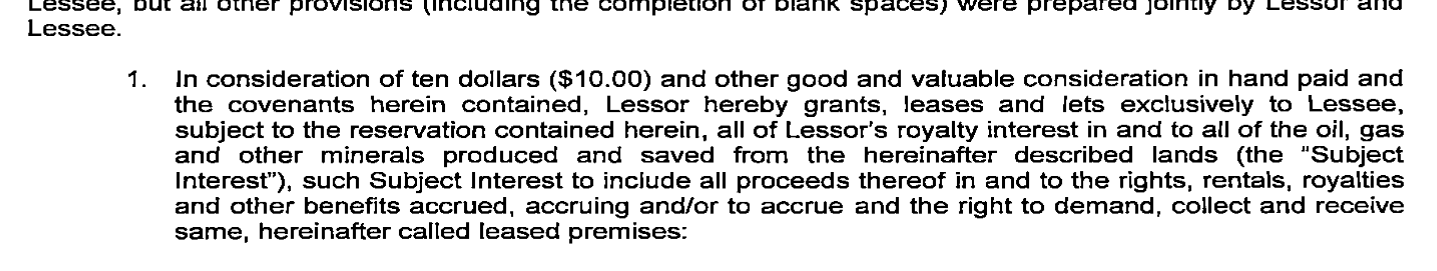

First, look at the granting language (usually the first paragraph). If the “lease” claims to convey a “royalty interest” in your oil and gas/mineral interest to the company leasing the minerals from you, then it’s a royalty deed, even if it’s titled something else. For instance:

By contrast, if the lease claims to convey “the right to lease for the purpose of exploration etc.” to the company, then it’s properly a lease.

Second, check if the property in question has already been leased to another operator. If it has (and the lease hasn’t expired or is producing), then the lease is probably not valid. It might not be a scam, but it shows someone hasn’t done their homework. So be wary before signing anything.

Obviously, just because it’s a lease doesn’t mean it’s safe to sign. But you can be pretty sure that if it’s a royalty deed masquerading as a lease, you should not sign it.

What if you’ve already signed one of these fake leases? Contact an attorney. Purveyors of these fake oil and gas leases have been successfully sued in the past, so it’s possible that you can have the deed invalidated as fraudulent and recover damages (including perhaps punitive damages).